Sum of the years' digits Partial year YouTube

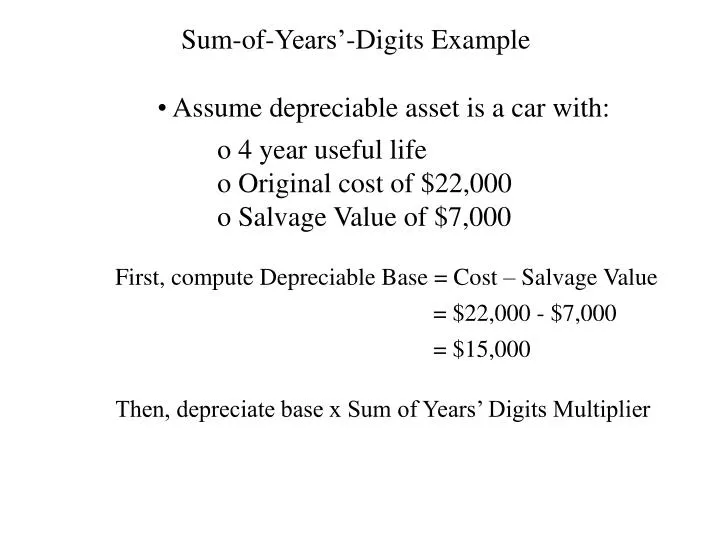

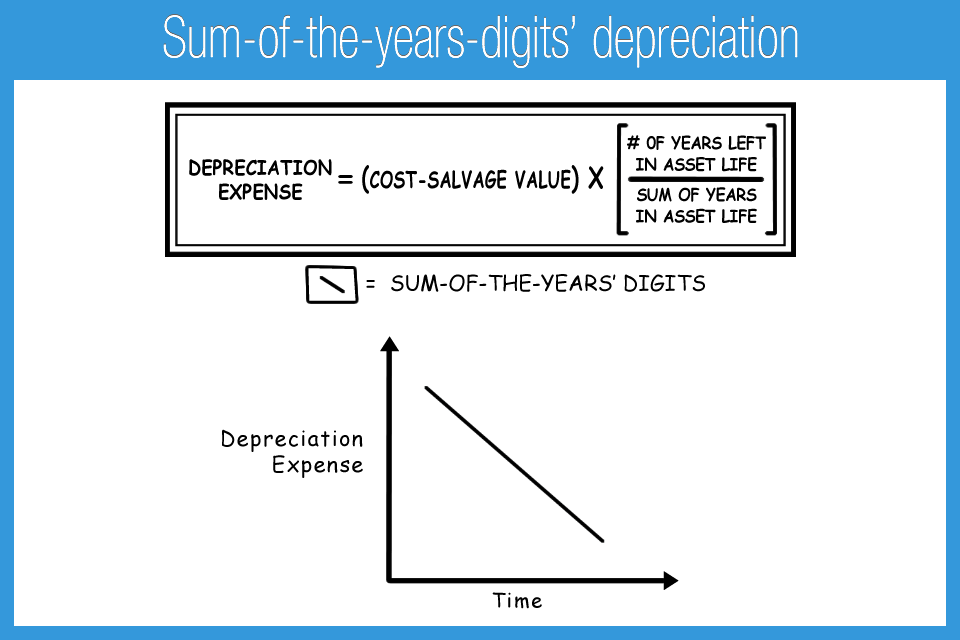

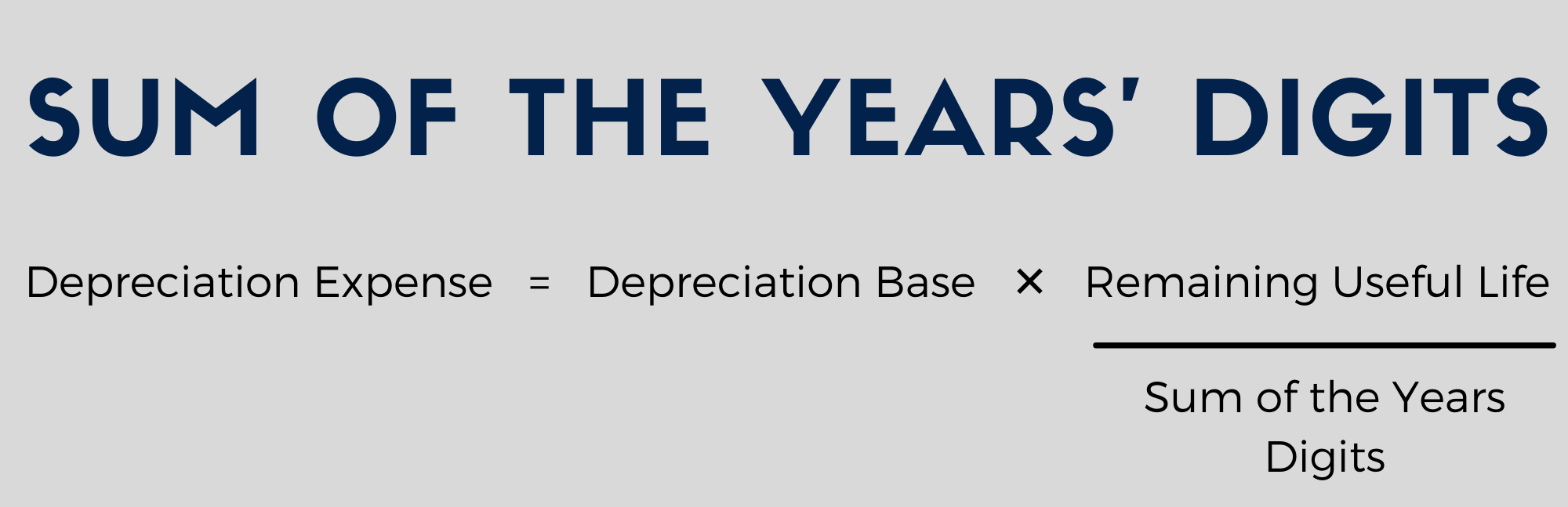

The Sum-Of-The-Years' Digit Method. The sum-of-the-years' digit method is an accelerated depreciation method. We can define the method as, 'The depreciation expense in the initial years is higher than that of the later years. The number of years across which asset is utilized adds up. The remaining years are divided by the total useful life.

PPT SumofYears’Digits Example PowerPoint Presentation, free download ID1331389

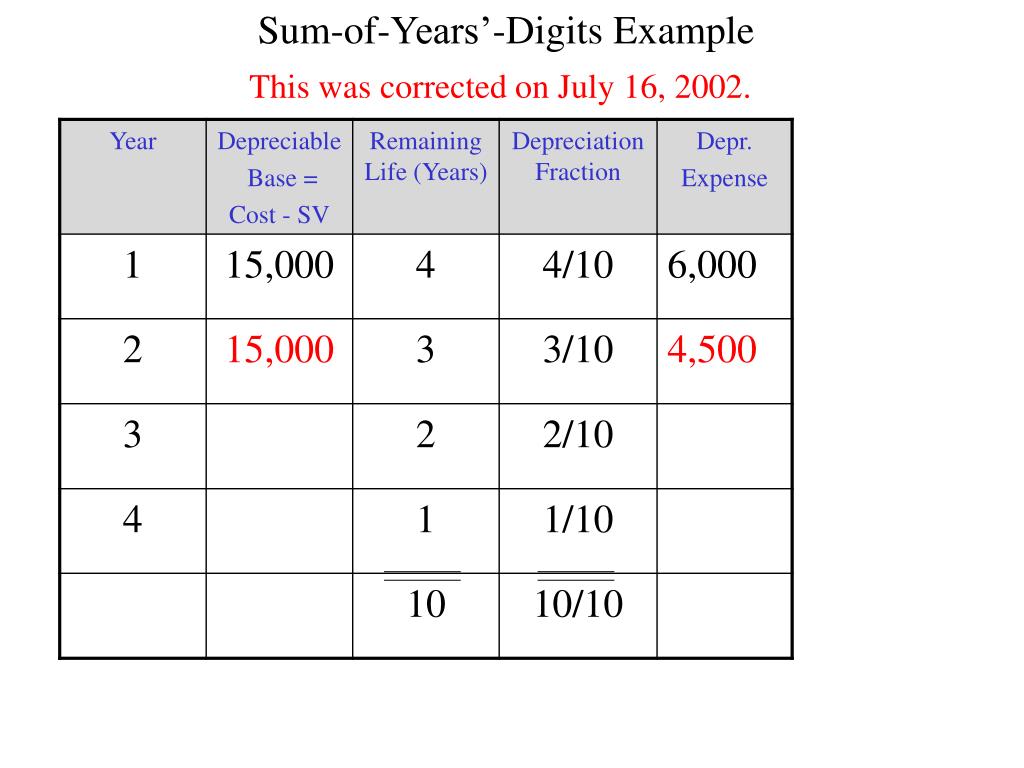

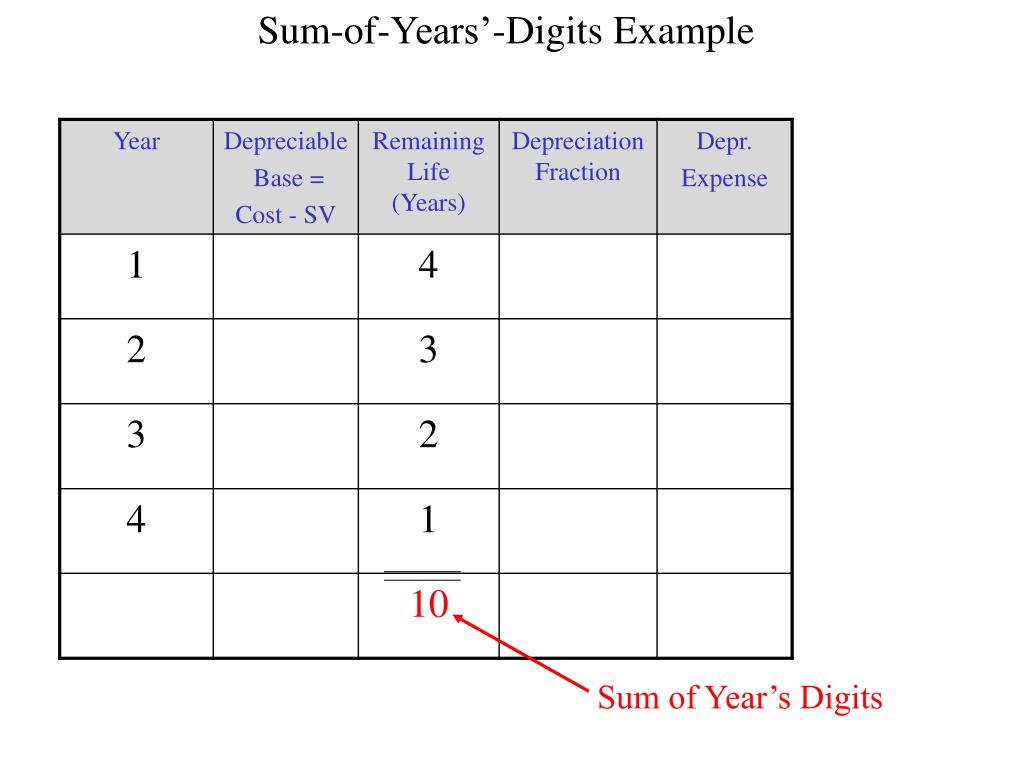

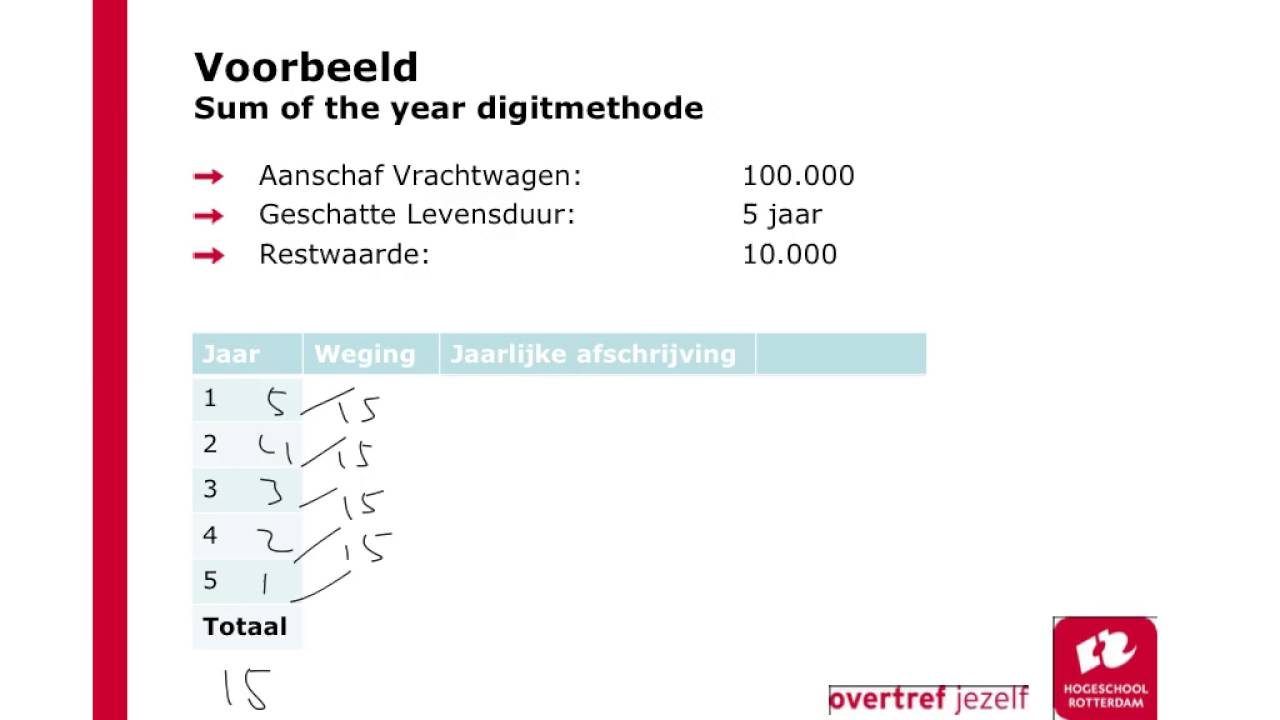

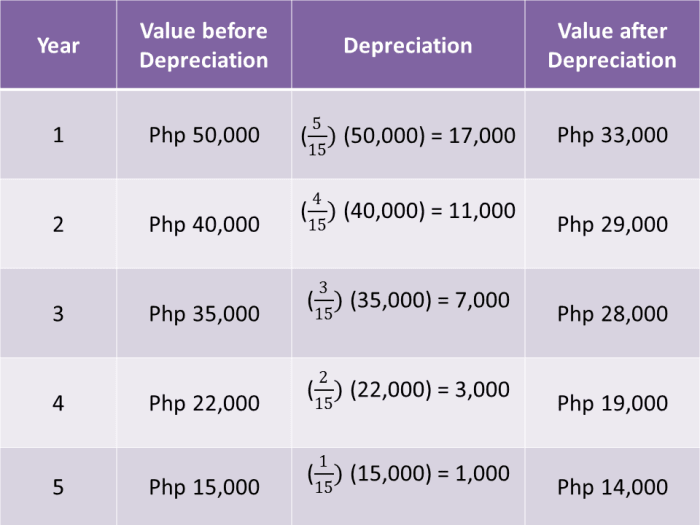

The sum of years method uses the expected life and adds the digits for every year to give the final depreciation expense amount. Say, the useful life of the asset is 5 years. So, the sum of the years is obtained by adding up the year's digits as 5+4+3+2+1 = 15.. Every digit is then divided by this total to get the percentage depreciation.

PPT SumofYears’Digits Example PowerPoint Presentation, free download ID1331389

With the information in the example, the company ABC can calculate the sum of years digits depreciation for the machine with the formula as below: Sum of years digits depreciation = (Remaining useful life / Sum of years' digits) x Depreciable cost. Sum of years' digits = 8 + 7 + 6 + 5 + 4 + 3 + 2 +1 = 36. Depreciable cost = $52,000.

sumoftheyears'digits method partial year YouTube

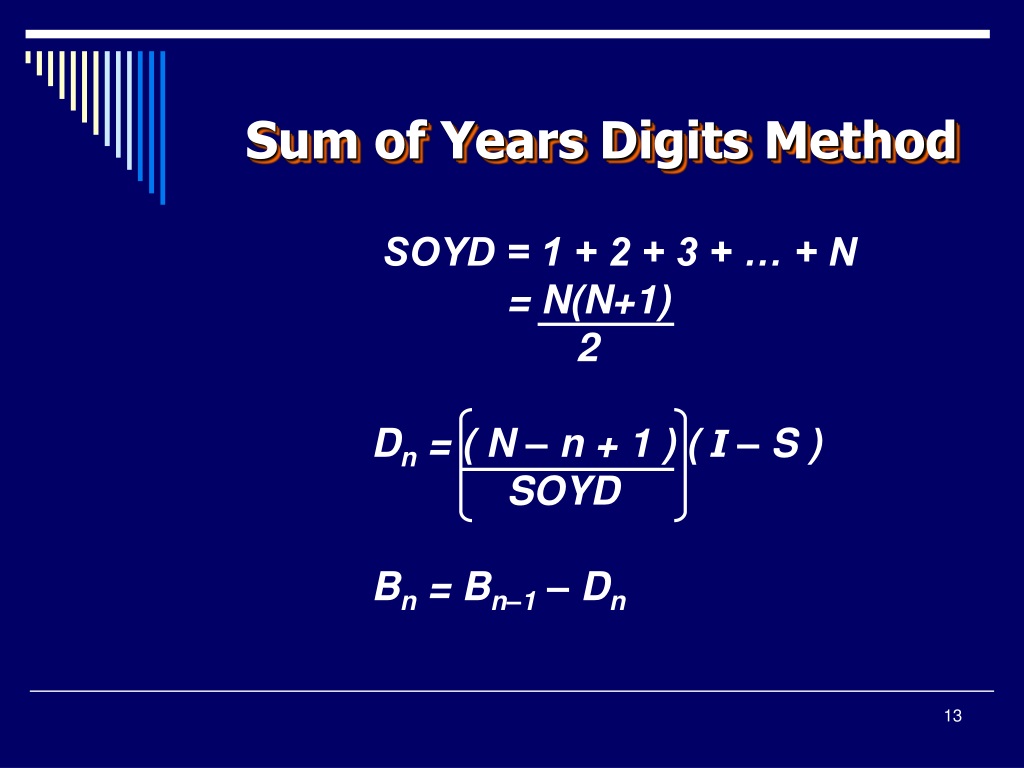

The depreciation charge and the total depreciation at any time m using the sum-of-the-years-digit method is given by the following formulas:. Depreciation Charge:

Sum of Years' Digits Depreciation Accountingo

Depreciation is taken as a fractional part of a sum of all the years. For example, if an asset has a life of 5 years the sum of years is 1+2+3+4+5 = 15. Fractional parts are built with the year as the numerator and the sum of years as the denominator but, in reverse order. Year 1 is 5/15 * depreciable cost, Year 2 is 4/15 * depreciable cost.

Sum Of The Years Digits' Depreciation Accounting Play

Residual Value = $10,000. Useful Life = 3 Years. Calculate depreciation over the useful life of the asset using the sum of the years' digits method. Step 1: Calculate the sum of the years digits. Sum of the years' digits = 3 + 2 + 1 = 6. Step 2: Calculate the depreciable amount. Depreciable amount = $100,000 - $10,000 = $90,000.

B5 Sum of the year digit methode YouTube

Step 1: Calculate sum of years. If useful life is 5 years, the sum of the years digit would be 5 + 4 + 3 + 2 + 1 = 15. Step 2: Every digit is divided by its total to get the depreciation percentage each year. The depreciation percentage for each year is calculated by the years remaining in the useful life divided by the sum of the remaining.

Sum of Years Digits Depreciation Method YouTube

The depreciation factor is the useful life of the asset (in years) divided by the sum of all the useful years. The formula below summarizes the process: Where: n - Useful life of the asset (ex. 4 years) ∑n - Sum of years (e.g., 4 years: 1+2+3+4 = 10) Depreciable amount - (Total Acquisition Cost - Salvage Value)

Sum of the Years Digits YouTube

The sum of the years' digits method is used to accelerate the recognition of depreciation. Doing so means that most of the depreciation associated with an asset is recognized in the first few years of its useful life. This method is also called the SYD method. The method is more appropriate than the more commonly-used straight-line depreciation.

PPT SumofYears’Digits Example PowerPoint Presentation, free download ID1331389

Sum-Of-The-Years' Digits: Sum-of-the-years'-digits is an accelerated method for calculating an asset's depreciation. This method takes the asset's expected life and adds together the digits for.

Sum of the Years Digits Method of Depreciation Formula Example YouTube

Step 1: Calculate Sum of the Years' Digits. To figure out the depreciation expense of each year, we first need to calculate is the sum of the years digits. Since the useful life of the truck is four years, we need add all numbers that fall between 4 and zero to find the sum. Sum of the years' digits = 4 + 3 + 2 + 1 = 10.

18. depreciation formula for sumoftheyearsdigits YouTube

If the above formula is used for an asset having a useful life of 10 years, the sum of the digits will be: 10 (10+1)/2 = 10 (11)/2 = 110/2 = 55. In the first year of an asset with a 10-year useful life, the depreciation will be 10/55 of the amount to be depreciated. The second year will use 9/55 and the tenth year will use 1/55.

Methods of Depreciation Formulas, Problems, and Solutions Owlcation Education

What 1 formula is used for the Sum of the Years Digits (SOYD) Depreciation Calculator? D t = ( (A - S) * (N - t + 1))/Σ 1 st n integers. For more math formulas, check out our Formula Dossier.

Sumoftheyearsdigits' depreciation Accounting Play

To calculate depreciation charges using the sum of the years' digits method, you'll need to first get the depreciable base, which is the cost of the asset. Second, you'll calculate the salvage value of the asset, which works the same for both the SYD and straight-line depreciation methods. For example, if you buy an asset for $100,000 and it.

Sum of Years' Digits Depreciation Accountingo

Sum of Years Digits Depreciation is one of the Accelerated Depreciation Methods.During the initial time periods, depreciation is value is high. The depreciat.

PPT Depreciation PowerPoint Presentation, free download ID9591902

Learn how to depreciate using the sum-of-the-years'-digits method.To download this spreadsheet and follow along with the video, please click here: https://ww.